nh food tax rate

See the recorded documents for more. The assessed values are subject to change before being finalized for ad valorem tax purposes.

New Hampshire Sales Tax Handbook 2022

Owner NH broker.

. Notary and Justice of the Peace services are available. 2021 Consumer Confidence Report. The assessing parcel maps are compiled from official records including surveys and deeds but only contain the information required for assessment.

Monday Tuesday Thursday Friday. A state or district such as District of Columbia may have a general sales tax of 6 but set the tax rate on liquor and prepared food at 10. Price Down Payment Interest.

Bills can be viewed on the online kiosk. Upcoming Mobile Food Bank Event. The assessing parcel maps are for assessment use only and do NOT represent a survey.

Mail check - PO Box 660 Barrington NH 03825. February 15 2022 - Delinquency letter mailed out for 2021 unpaid taxes. Your federal tax forms 1099G for the 2021 tax year will be available online by January 31st.

Tax rate has been set. New Hampshire for example has no general sales tax but still taxes restaurants food services hotels room rentals and motor vehicle rentals at 9. Bring your plans 2 other lots available builder tie in.

State of New Hampshire and the Towns of Hampton North Hampton Rye Seabrook and New Castle to operate seacoast beaches during. February 21 2022 - Presidents Day - Closed Payment Options. Listed by Derek Greene of Derek Greene.

Water. Federal 30-year interest rate. Close to all of the wonderful amenities NH has to offer.

23 Edgemont Rd. Town Clerk Tax Collector. Price is based on builder allowances.

NHDES Sanitary Survey 2017. Fuel Assistance Weatherization Programs. Official NH DHHS COVID-19 Update 34.

Regarding December tax bills - new tax rate 1950 per thousand of assessed value was 2277 down 327. You will receive a 1099G if the total amount of Unemployment Benefits paid to you during calendar year 2021 is at least 10. 392 last updated on Feb 17.

Massachusetts for example only starts counting sales tax associated with. 2nd issue bill due date is 1102022. Official NH DHHS COVID-19 Update 34b.

If you are unable to view the 1099G on your dashboard please continue to check for your paper 1099G arriving by traditional mail. Food Service guidance issued on May 18 2020. COVID-19 NH Division of Public Health Services updated December 4 2020.

800am to 500pm Wednesday. Property Index Map Cover2020 Street Index 12345678910A A-4 B B-3B-4B-5 CC-1C-2C-3C-4C-5 DD-1D-2D-3D-4D-5D-6 EE-1E-2E-3E-4E-5E-6E-7 F F-2F-3F-4F-5F-6F-7F-8F-9 G G-2G-3G-4G-5G-6G-7G-8G-9 H H-3H-4H-5H-6H-7H-8H-9 I I-3I-4I-5I-6I-7I-8I-9I-10J J-3J-4J-5J-6J-7J-8J-9J-10K K-3K-4K-5K-6K-7K-8K-9K-10L L-4. The Town Clerk Tax Collectors office serves the needs of our residents and taxpayers of the Town of Gilmanton in accordance with the laws of the State of New Hampshire.

2021 TAX FORMS - 1099G. Tax Rate. In consistent low tax town of Holderness NH.

Read more You are here.

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

Is New Hampshire Really As Anti Tax As It S Cracked Up To Be Stateimpact New Hampshire

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

States With Highest And Lowest Sales Tax Rates

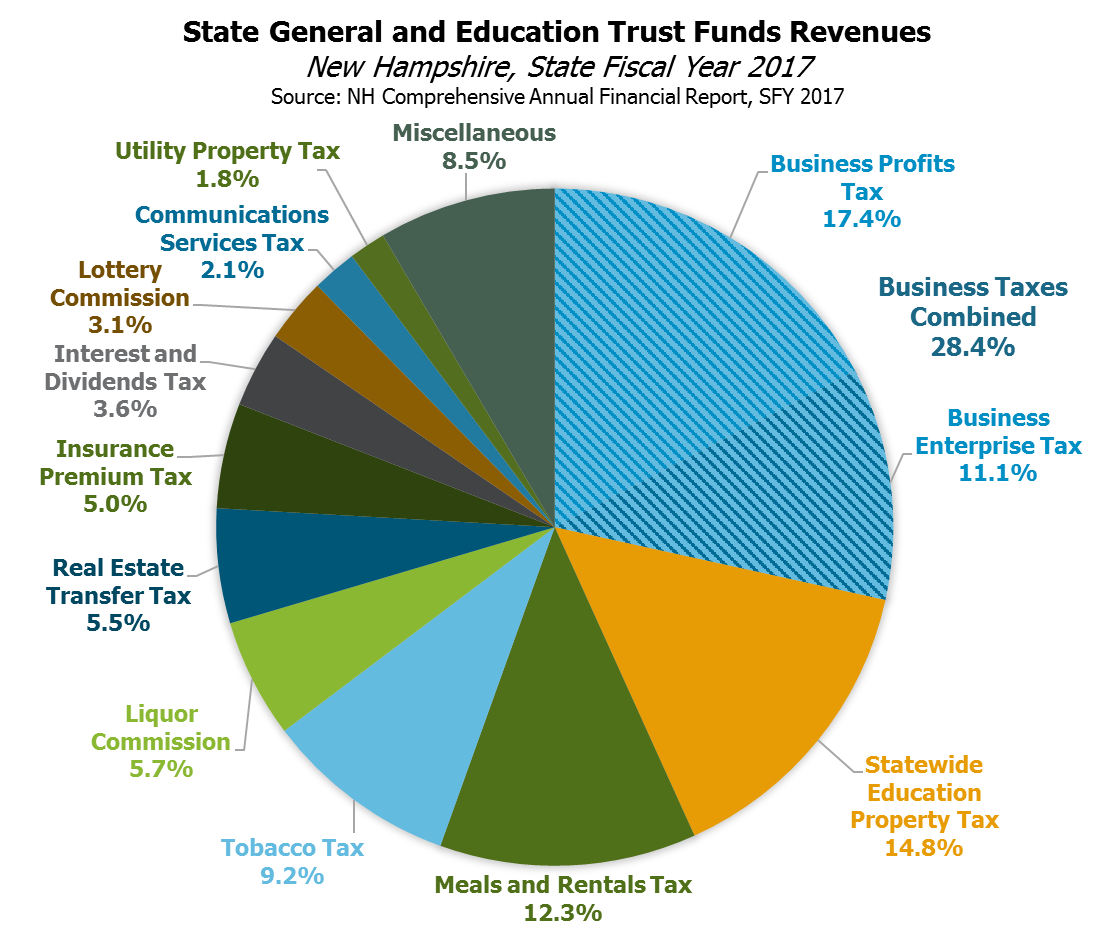

How We Fund Public Services In New Hampshire New Hampshire Municipal Association

Understanding New Hampshire Taxes Free State Project

New Hampshire Sales Tax Rate 2022